Why is investing more important than saving?

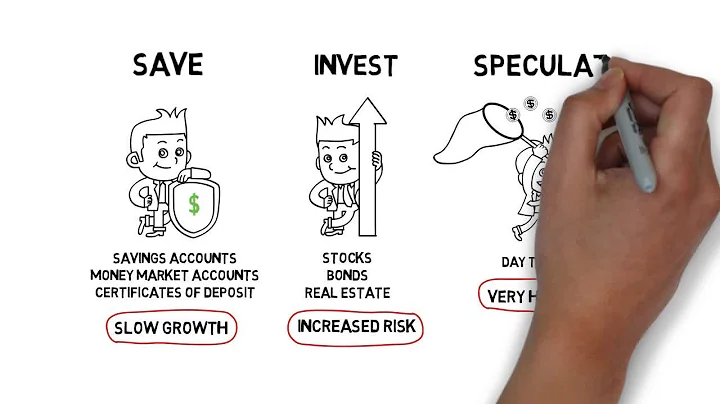

Saving and investing are both important components of a healthy financial plan. Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals. However, investing also comes with the risk of losing money.

Investing provides the potential for (significantly) higher returns than saving. As your investments grow, they allow you to take advantage of compounding to accelerate gains. Investing offers many different access points and strategies, from individual stocks and bonds to mutual or exchange-traded funds.

As savings held in cash will tend to lose value because inflation reduces their buying power over time, investing can help to protect the value of your money as the cost of living rises. Over the long term, investing can smooth out the effects of weekly market ups and downs.

Usually money invested over the long-term can give higher returns than savings accounts, depending on interest rates and levels of risk. Consider investing if you: want the chance of getting a higher return than you'd get putting your money into a savings account. are willing to accept an element of risk to your money.

The correct answer is remain constant. National income is the final value of goods and services produced and expressed in terms of money at current prices. Savings are not part of GDP or Income. Hence, If saving exceeds investment, the National Income will remain constant.

Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

- Interest Rates Can Vary. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

- Grow your money when you start investing.

- Start investing to beat inflation.

- Achieve financial goals and spend on those you love.

- Achieve financial independence and retire comfortably.

- Investing is a necessary.

Even if you suffer losses in the short-term, you have more flexibility to recover and benefit from the positive effects of long-term investing. In other words, by investing early and regularly, you can take advantage of the power of compounding, which means your money can grow exponentially over time.

Aim for building the fund to three months of expenses, then splitting your savings between a savings account and investments until you have six to eight months' worth tucked away. After that, your savings should go into retirement and other goals—investing in something that earns more than a bank account.

Does investing make you more money?

If you want to become a millionaire, investing money can help make that happen. If you open a brokerage account and begin buying assets that provide a generous return, the money your investments earn can be reinvested and earn even more for you. This is called compound growth, and it's a powerful wealth-building tool.

Just remember that while it's great to watch your savings grow, you can have too much of a good thing. “There is an opportunity cost to holding onto too much cash,” Stroup said. “Each year those dollars lose purchasing power as a result of inflation.

- You're building a strong emergency fund. Life throws curveballs. ...

- You end each month with extra money. Your emergency fund is looking good. ...

- You're ready to commit to some financial goals. ...

- You have access to a retirement plan. ...

- The signs say you're ready to start investing?

90% Of Millionaires Are Made In Real Estate - 100% Of Billionaires Are Made HERE.

What makes up Musk's net worth. Musk lacks significant tranches of cash; his money is largely tied up in ownership stakes of his companies. To buy Twitter in 2022, he leveraged his large share in Tesla and solicited investors, rather than relying on liquid sums.

Millionaires prioritize avoiding consumer debt, making wise financial decisions, and aligning spending with long-term goals.

- Interest rates are variable, not fixed.

- Inflation might erode the value of your savings.

- Some financial institutions require a minimum balance to earn the highest interest rate.

- Some accounts might charge fees.

Using a savings account and an emergency fund for short-term expenses is important, but investing for retirement and the future is arguably just as crucial. While it may feel pointless to start investing if you don't have much money, it can still be incredibly worthwhile.

- Risk of Loss. There's no guarantee you'll earn a positive return in the stock market. ...

- The Allure of Big Returns Can Be Tempting. ...

- Gains Are Taxed. ...

- It Can Be Hard to Cut Your Losses.

While the product names and descriptions can often change, examples of high-risk investments include: Cryptoassets (also known as cryptos) Mini-bonds (sometimes called high interest return bonds) Land banking.

When should you transition from saving to investing?

The simple rule: If you need the money in the next three years, then save it ideally in a high-yield savings account or CD. If your goal is further out, or you don't have a specific need for the money, then start thinking about investing in something that will grow more, like stocks or bonds.

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

- Money market funds.

- Mutual funds.

- Index Funds.

- Exchange-traded funds.

- Stocks.

Savings accounts offer lower risk, while investing can potentially offer higher returns but with more risk. If you have a shorter timeline for purchasing a house (within the next few years), it may be better to save in a high-yield savings account or a CD to ensure the money is there when you need it.

Money Market Account Rates

Money market rates can be substantially greater than traditional savings account rates; however, they typically require a higher minimum balance requirement. If you're comfortable leaving a set amount in the account, a money market can easily help you grow savings with a guaranteed return.

Investing in yourself can:

Build your confidence, Broaden your perspective, Develop your purpose, and. Increase your wealth.

References

- https://www.morganstanley.com/articles/what-to-invest-in-during-inflation

- https://dfi.wa.gov/financial-education/information/basics-investing-stocks

- https://www.quora.com/Does-the-money-in-a-Roth-IRA-keep-up-with-inflation

- https://www.moneytalkgo.com/23-reasons-to-invest-now/

- https://talkmarkets.com/content/how-much-money-do-i-need-to-invest-to-make-3000-a-month?post=431352

- https://www.tiktok.com/@kriskrohn/video/7249446262897085742

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.fca.org.uk/investsmart/understanding-high-risk-investments

- https://www.bpi-aia.com.ph/en/about-us/articles/building-my-wealth/infographic-investing-vs-spending-know-the-difference-to-help-you-grow-your-money

- https://www.forbes.com/sites/rachelwells/2024/01/22/8-high-income-skills-to-learn-in-2024/

- https://www.cnbc.com/select/investing-tips-for-beginners/

- https://www.fca.org.uk/investsmart/should-you-invest

- https://www.nerdwallet.com/article/investing/what-is-passive-income-and-how-do-i-earn-it

- https://www.linkedin.com/pulse/finance-decision-making-manish-agarwal

- https://www.investopedia.com/ask/answers/04/030504.asp

- https://www.merchantsbank.com/blog-articles/make-your-money-work-for-you-why-investing-is-key

- https://fortune.com/recommends/banking/saving-vs-investing/

- https://finance.yahoo.com/news/5-stocks-confidently-invest-500-113300157.html

- https://www.experian.com/blogs/ask-experian/how-much-money-do-you-need-to-start-investing/

- https://time.com/personal-finance/article/ways-to-invest-1k/

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.investor.gov/additional-resources/information/youth/teachers-classroom-resources/risk-and-return

- https://www.tataaia.com/blogs/financial-planning/5-important-steps-of-the-investment-process.html

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://www.investopedia.com/articles/basics/10/investing-or-gambling.asp

- https://www.westernsouthern.com/investments/the-impact-of-inflation-on-your-savings-and-investments

- https://finance.yahoo.com/news/genius-ways-1-000-month-105500970.html

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://www.forbes.com/sites/truetamplin/2023/10/22/of-course-you-can-start-investing-with-100-heres-how/

- https://finred.usalearning.gov/assets/downloads/Basic%20Investing.pdf

- https://www.investopedia.com/10-investing-concepts-beginners-need-to-learn-5219500

- https://money.usnews.com/investing/articles/what-are-real-assetsinvesting-ideas

- https://ugcmoocs.inflibnet.ac.in/assets/uploads/1/238/7182/et/3_Script_Investment%20Decision200324060603034646.pdf

- https://www.linkedin.com/pulse/could-you-lose-purpose-investing-luck-vs-skill-cameron-hight-ord7e

- https://www.experian.com/blogs/ask-experian/how-to-choose-investment-strategy/

- https://www.boldermoney.com/blog/how-to-make-10-000-fast

- https://ag.ny.gov/resources/individuals/investing-finance/investment-guidance

- https://www.quora.com/What-was-your-best-financial-decision-that-benefited-you-much-later-in-life

- https://www.linkedin.com/pulse/trading-side-hustle-hidden-truth-success-rkxgc

- https://testbook.com/question-answer/if-saving-exceeds-investment-the-national-income--5c0a3eebe33ce40c9ea2b2bc

- https://moneywise.com/a/ch-aol/hybrid-its-not-taxed-at-all?throw=C3DM1

- https://www.everydayhealth.com/neurology/importance-decision-making-process/

- https://www.investopedia.com/articles/basics/03/050203.asp

- https://www.voya.com/blog/7-easy-ways-to-start-investing-little-money

- https://www.fidelity.ca/en/insights/articles/invest-in-yourself/

- https://www.columbiathreadneedle.co.uk/uk-capital-and-income-investment-trust-plc/insights/benefits-of-investing/

- https://www.fool.com/investing/how-to-invest/saving-vs-investing/

- https://www.evalueserve.com/blog/9-types-of-risks-in-banking/

- https://brainly.com/question/32509599

- https://www.forbes.com/advisor/investing/best-low-risk-investments/

- https://finhabits.com/what-is-the-best-way-to-invest-to-save-for-a-house/

- https://www.thrivent.com/insights/investing/how-to-invest-during-inflation

- https://www.investopedia.com/terms/i/investmentstrategy.asp

- https://www.investopedia.com/articles/investing/111414/tips-how-beat-inflation-older-investors.asp

- https://homework.study.com/explanation/is-it-possible-to-reverse-inflation.html

- https://www.wellsfargo.com/goals-investing/why-invest/

- https://www.debtfreedr.com/10-things-millionaires-do-not-spend-money-on/

- https://www.washingtonpost.com/technology/2024/02/01/elon-musk-wealth-net-worth-companies/

- https://www.peachstatefcu.org/blog/which-savings-account-will-earn-you-the-most-money-reveal-your-answer

- https://smartasset.com/investing/how-much-money-to-invest-in-stocks-per-paycheck

- https://www.investopedia.com/terms/i/investment.asp

- https://www.nasdaq.com/articles/how-far-will-%24100-per-month-go-by-investing-in-the-sp-500

- https://corporatefinanceinstitute.com/resources/wealth-management/inflation-hedge/

- https://www.investopedia.com/articles/trading/05/011705.asp

- https://www.investopedia.com/articles/investing/080813/how-profit-inflation.asp

- https://www.fool.com/the-ascent/buying-stocks/articles/will-investing-100-a-month-really-make-a-difference-in-your-net-worth/

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://tpfcu.com/blog/save-or-invest-which-is-right-for-you/

- https://www.investopedia.com/articles/investing/092514/better-inflation-hedge-gold-or-treasuries.asp

- https://www.nasdaq.com/articles/5-key-signs-youre-keeping-too-much-money-in-your-savings-account

- https://smartasset.com/financial-advisor/where-do-millionaires-keep-their-money

- https://www.investopedia.com/investing/steps-successful-investment-journey/

- https://www.forbes.com/advisor/investing/best-inflation-stocks/

- https://www.fool.com/the-ascent/buying-stocks/articles/how-quickly-can-investing-make-you-a-millionaire/

- https://www.kotaksecurities.com/share-market/10-golden-rules-of-investing-in-stock-market/

- https://www.investopedia.com/terms/i/inflation-hedge.asp

- https://www.cnbc.com/select/why-you-shouldnt-avoid-investing-with-a-small-amount-of-money/

- https://finance.yahoo.com/news/made-not-born-dave-ramsey-110000138.html

- https://finance.yahoo.com/news/got-500-invest-stocks-put-110000748.html

- https://smartasset.com/investing/how-to-profit-from-inflation

- https://www.piranirisk.com/blog/4-types-of-financial-risks

- https://www.linkedin.com/pulse/10-skills-every-millionaire-needs-upulakshie-kodithuwakku

- https://www.experian.com/blogs/ask-experian/pros-cons-of-buying-stocks/

- https://www.lloydsbank.com/savings/help-and-guidance/save-or-invest.html

- https://am.jpmorgan.com/us/en/asset-management/liq/resources/investment-academy/evaluating-risk/Money-market-fund-risks/

- https://www.plynkinvest.com/learn/beating-inflation-through-investing/

- https://www.paystand.com/blog/financial-decision-making

- https://www.investopedia.com/should-you-save-your-money-or-invest-it-depends-4692975

- https://www.investopedia.com/articles/markets/121515/8-high-risk-investments-could-double-your-money.asp

- https://www.quora.com/In-terms-of-skill-is-investing-or-trading-considered-more-challenging-Why

- https://www.investopedia.com/financial-edge/0812/5-places-to-keep-your-money-when-you-dont-trust-the-banks.aspx

- https://insights.masterworks.com/finance/investing-strategies/who-benefits-from-inflation/

- https://partners-cap.com/insights/basic-lessons-of-investing/

- https://www.wellsfargo.com/goals-investing/saving-vs-investing/

- https://www.centerfinplan.com/money-centered/2020/2/11/the-single-most-important-investing-decision

- https://www.chime.com/blog/5-best-investments-during-inflation/

- https://whitetopinvestor.com/learning-investing-fun-interesting/

- https://en.wikipedia.org/wiki/Impact_investing

- https://www.investopedia.com/terms/c/capital-investment.asp

- https://www.tonyrobbins.com/high-income-skills/

- https://srfs.upenn.edu/financial-wellness/blog/power-compound-interest

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.ciro.ca/office-investor/understanding-risk

- https://smartasset.com/investing/pros-and-cons-of-stocks

- https://www.forbes.com/advisor/investing/how-to-hedge-against-inflation/

- https://smartasset.com/investing/how-to-invest-500-dollars

- https://ethis.co/blog/reasons-why-you-should-start-investing/

- https://www.wsj.com/buyside/personal-finance/saving-vs-investing-01657732972

- https://homework.study.com/explanation/what-is-the-most-important-type-of-decision-that-the-financial-manager-makes-select-the-best-choice-below-a-the-financial-manager-s-most-important-job-is-to-make-the-firm-s-investment-decisions-b-the-financial-manager-s-most-important-job-is-to-mak.html

- https://www.trive.com/articles/what-is-the-importance-of-investments-for-economic-growth

- https://www.examveda.com/is-the-most-important-investment-decision-because-it-determines-the-risk-return-characteristics-of-the-portfolio-30157/

- https://www.fool.com/investing/how-to-invest/how-to-invest-100-dollars/

- https://www.fidelity.com/learning-center/wealth-management-insights/6-ways-to-help-protect-against-inflation

- https://quizlet.com/762387691/mrs-jones-investment-test-31-32-flash-cards/

- https://www.fidelity.com/learning-center/smart-money/what-is-investing

- https://www.fool.com/investing/2024/01/10/these-2-stocks-are-beating-average-inflation/

- https://www.investopedia.com/ask/answers/111414/does-inflation-favor-lenders-or-borrowers.asp

- https://www.forbes.com/sites/pattieehsaei/2023/10/12/you-can-afford-to-invest-start-with-just-100-per-month/

- https://fortune.com/recommends/investing/how-to-start-investing/

- https://www.principal.com/individuals/build-your-knowledge/when-start-investing-4-signs-youre-ready

- https://www.aei.org/op-eds/wealthier-people-benefit-from-inflation-while-the-working-class-bears-the-costs/

- https://www.investopedia.com/articles/basics/06/invest1000.asp