How long can some online payments take to process?

In the US, payment processing times vary by method. Credit and debit card transactions are often processed instantly, but funds can take a few days to clear. ACH or Direct Debit transactions typically take 1-3 business days, while wire transfers are usually processed the same day.

Learn more here. You can typically expect credit card payments to show up in your account within 2-3 business days. ACH transfers take approximately 7-10 business days.

Online bank transfers might take a long time for a number of reasons, including global events or natural disasters, bank holidays, different currencies, weekend delays, missing paperwork, time differences, different banking regulations, fraud detection processes, and the risk profile of the sender.

Payments made directly through your checking or savings account (via ACH) may take up to 5 business days to finish processing (not including Saturdays, Sundays, or bank holidays). For example, ACH payments made on Monday will clear the following Monday, and ACH payments made on Friday will clear the following Friday.

Payment processors generally don't process every single payment at once. They batch payments together and send them for processing all at the same time. This can happen as quickly as twice a day, or as rarely as twice a week. There's another reason for the delay: fraud detection.

The most common reasons for your payment to fail are either filters your bank applies to certain transactions made online, or amount limitations applied to your card. If your payment is being rejected, please reach out to your bank to get additional information.

Each bank has a “funds availability" policy, which details how long it's able to hold your deposits before posting them, in essence making them available in your account. Most transactions will post within one business day, though there are some exceptions.

Your payment is credited when the credit card issuer acknowledges that you've made the payment. As long as you make your digital payment by 5 p.m. on a business day, your payment should be credited that same day. If you make a digital payment after 5 p.m., it may be credited the next business day.

Many pending charges disappear in around 5 days or less. Though some institutions may have a longer period.

Since eChecks rely on financial institutions to process the transaction, most are limited to business days. Your payment will process three to five business days after your transaction is authorized. For example, if you make a payment on Monday, your payment could clear as early as Thursday.

What are the stages of payment processing?

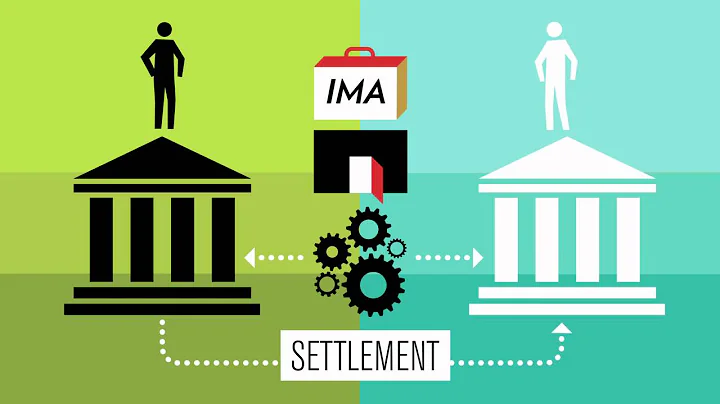

There are three stages to payment processing: validation, reservation, and finalization. The payment life cycle is related to the order life cycle stages: order capture, release to fulfillment, and shipping. Ensures that a customer has adequate funds to make the purchase.

Does processed mean paid? Processed does not necessarily mean paid. If the bank says a transaction has been processed, that can mean that it has been authorized and authenticated but not yet settled - meaning, the seller may not see the funds in their account yet.

Generally speaking, credit card issuers don't have a time limit for charging a customer's credit card. The issuing banks, however, will often impose a limit on merchants for charging. These limits can range anywhere from three to 30 days.

However if the money was deducted for such a transaction although the website showed it as failed, do not worry, it will be refunded back automatically by the bank.

A Not Processed message may occur for payments that are authorized but remain uncaptured. The transaction will ultimately decline. The following day, it will change from Not Processed to Successful Void.

Yes, a pending transaction can be declined. A pending transaction is a temporary hold placed on funds in an account, typically when a card is used to make a purchase or when a check is deposited. The hold ensures that the funds are available for the merchant to process the transaction.

Common reasons for missing transactions

Wrong bank - The transaction is entered against the wrong bank account. Transaction type - The transaction is not a bank transaction. Grouped transactions - The transaction is grouped with other transactions.

The fastest way to resolve this issue is to contact the merchant directly. If they're able to remove the pending transaction, it should be reflected in your account in about 24 hours. If they're not able to help you, pending transactions will fall off automatically after 7 days.

When a transaction is authorised, it's confirming to the merchant your card is valid and there's money in your account to pay for what you're buying. The transaction amount is then deducted from your available funds, and the transaction shows as pending on your account until the payment process is complete.

A transaction typically stays pending for one to three business days. During this time, your bank or financial institution processes the request and transfers money from one account to another according to your purchase or deposit amount.

What time do banks start processing transactions?

Business days for banks are typically Monday through Friday from 9 a.m. to 5 p.m., excluding federal holidays. Transactions received outside of these hours are typically posted on the next business day.

These take longer to clear (6 business days) because the requesting bank needs to send instructions to the originating bank to authorise the transaction and verify that the funds are available (see the next section below).

The basics of payment processing

This means that they are ringfencing the account holder's funds on the expectation that they will need to make payment later. Once the payment request is presented, the bank will release the funds. This is, however, not always the end of the story.

Online payment methods

To make a purchase, customers enter their credit or debit card information into a payment gateway. This method involves the transfer of funds directly from the customer's bank account to the business's bank account, not their merchant account.

Transaction processing systems generally go through a five-stage cycle of 1) Data entry activities 2) Transaction processing activities 3) File and database processing 4) Document and report generation 5) Inquiry processing activities.

References

- https://ebizcharge.com/blog/what-are-bank-cutoff-times/

- https://supporthub.g2a.com/seller/en/solving-problems/my-auctionaccount-has-been-suspended-what-can-i-do-

- https://www.nationwide.co.uk/help/payments/send-money-to-another-account

- https://www.metrobankonline.co.uk/help-and-support/payments/what-is-a-pending-transaction-and-how-long-can-it-stay-pending/

- https://www.sofi.com/learn/content/how-to-cancel-a-pending-transaction/

- https://www.helpwithmybank.gov/help-topics/bank-accounts/nsf-fees-overdraft-protection/index-nsf-fees-overdraft-protection.html

- https://paysimple.com/blog/how-do-echecks-work/

- https://www.articlesfactory.com/articles/ecommerce/is-g2a-legite.html

- https://paymentcloudinc.com/blog/merchant-account-holding-funds/

- https://pay.g2a.com/terms-and-conditions

- https://supporthub.g2a.com/marketplace/en/payments/my-paymenttransaction-was-refunded-when-and-how-will-i-receive-my-funds-back

- https://supporthub.g2a.com/marketplace/en/payments/my-paymenttransaction-failed-what-should-i-do

- https://www.nerdwallet.com/au/credit-cards/what-are-pending-transactions

- https://www.nerdwallet.com/article/credit-cards/how-long-does-a-credit-card-payment-take-to-process

- https://indstuds.yolasite.com/resources/08.tps.pdf

- https://business.adobe.com/blog/basics/understanding-payment-process

- https://www.experian.com/blogs/ask-experian/how-long-does-it-take-for-credit-card-payment-to-post/

- https://bankline-faq.natwest.com/Accounts/Balances-Statements/1866042512/What-are-the-faster-payment-reject-and-return-reason-codes.htm

- https://www.synovus.com/personal/resource-center/managing-your-finances/fast-facts-what-is-my-real-balance-in-my-checking-account

- https://cdn.mycrowdwisdom.com/wespay/docs/IPBrief1_TheDifferenceBetweenInstantAndFasterPayments.pdf

- https://supporthub.g2a.com/marketplace/en/payments/what-payment-methods-can-i-use-when-paying-on-g2acom

- https://3s.money/help-centre/sending-and-receiving-payments/why-is-my-payment-taking-so-long

- https://www.sofi.com/learn/content/what-does-pending-transaction-mean/

- https://supporthub.g2a.com/marketplace/en/Problem-Solving/i-want-to-cancel-an-order-can-i-do-that

- https://www.moneylion.com/learn/how-long-do-pending-transactions-take/

- https://kb.blackbaud.com/knowledgebase/articles/Article/189744

- https://www.g2a.com/news/safehub/is-g2a-safe-and-legit-place-to-buy-cheap-games/

- https://www.bvnk.com/blog/faster-payments-scheme-a-quick-guide-to-business-to-business-transactions

- https://acquired.com/how-long-do-faster-payments-take/

- https://www.alliedpay.com/blog/transaction-declined/

- https://www.hsbc.co.uk/current-accounts/what-is-faster-payments/

- https://supporthub.g2a.com/marketplace/en/payments/my-payment-is-completed-but-its-now-stuck-on-verification-in-progress

- https://statrys.com/blog/delayed-bank-transfer

- https://arstechnica.com/gaming/2020/05/g2a-confirms-stolen-game-key-sales-pays-40000-to-factorio-devs/

- https://www.brex.com/resources/what-is-pending-credit-card-charge

- https://www.nab.com.au/help-support/personal-banking/manage-payments-transfers/payment-processing-times

- https://gocardless.com/guides/posts/faster-payments-explained/

- https://support.iconfinder.com/en/articles/3001024-reasons-why-credit-card-payments-fail

- https://www.lightspeedhq.co.uk/blog/how-long-does-it-take-for-a-credit-card-payment-to-go-through/

- https://www.thinkmoney.co.uk/help-support/payments-and-withdrawals/whats-a-faster-payment/

- https://www.wearepay.uk/what-we-do/payment-systems/faster-payment-system/payment-system-participant-list/

- https://www.lightspeedhq.com/blog/how-long-does-it-take-for-a-credit-card-payment-to-go-through/

- https://www.quora.com/Is-it-banned-to-buy-and-activate-a-Steam-account-from-G2A

- https://urbanarmorgear.zendesk.com/hc/en-us/articles/209611346-The-transaction-declined-but-the-money-was-removed-from-my-account

- https://moneyfactscompare.co.uk/current-accounts/guides/faster-payments-how-do-they-work/

- https://stripe.com/resources/more/how-credit-card-transaction-processing-works-a-quick-guide

- https://stripe.com/resources/more/payment-processing-explained

- https://supporthub.g2a.com/marketplace/en/Buying/i-purchased-a-digital-item-how-do-i-claim-it

- https://bankline-faq.rbs.co.uk/Accounts/Balances-Statements/1866042562/What-are-the-faster-payment-reject-and-return-reason-codes.htm

- https://supporthub.g2a.com/seller/en/solving-problems/how-can-i-contact-g2as-seller-support-team

- https://www.worldremit.com/en/blog/finance/do-bank-transfers-go-through-on-weekends-and-bank-holidays

- https://www.forbes.com/advisor/credit-cards/how-long-does-it-take-for-credit-card-payment-to-post/

- https://support.possiblefinance.com/hc/en-us/articles/9539260215181-Payment-Processing-Time

- https://gocardless.com/guides/posts/bacs-payments-pending-why-and-how-long/

- https://wise.com/help/articles/2977950/why-does-it-say-my-transfers-complete-when-the-money-hasnt-arrived-yet

- https://supporthub.g2a.com/marketplace/en/Problem-Solving/My-order-is-processing-What-does-that-mean

- https://supporthub.g2a.com/seller/en/getting-started/business-verification-and-business-accounts-on-g2acom-marketplace

- https://stripe.com/resources/more/online-payment-processing-101

- https://supporthub.g2a.com/marketplace/en/Buying/how-can-i-check-the-status-of-my-order-what-do-these-statuses-mean

- https://www.cardfellow.com/blog/merchant-account-holds/

- https://www.swipesum.com/insights/how-long-does-a-merchant-have-to-process-a-credit-card-transaction

- https://www.gocompare.com/current-accounts/reclaiming-misdirected-payments/

- https://supporthub.g2a.com/marketplace/en/Problem-Solving/my-transaction-has-failed-what-should-i-do

- https://supporthub.g2a.com/marketplace/en/Buying/why-are-keys-on-g2acom-so-cheap-

- https://ramp.com/blog/pending-credit-card-charges

- https://www3.mtb.com/personal-banking/checking/understanding-checking-account-transactions

- https://supporthub.g2a.com/marketplace/en/payments/how-can-i-pay-for-my-purchase-on-g2acom

- https://www.capitalone.com/learn-grow/money-management/pending-transactions/

- https://supporthub.g2a.com/marketplace/en/Buying/how-can-i-buy-a-digital-item-on-g2acom

- https://gocardless.com/guides/posts/what-are-payment-reversals-and-how-to-avoid-them/

- https://gb-kb.sage.com/portal/app/portlets/results/view2.jsp?k2dockey=200427112355286

- https://m.economictimes.com/wealth/save/international-online-transaction-is-unsuccessful-but-money-has-been-deducted-when-how-will-you-get-a-refund/articleshow/104231115.cms

- https://supporthub.g2a.com/marketplace/en/G2A-Services/is-g2a-a-legit-site

- https://www.wearepay.uk/what-we-do/payment-systems/faster-payment-system/how-faster-payments-work/

- https://www.commbank.com.au/articles/banking/what-are-pending-transactions.html

- https://moneylenderprofessional.com/forum/viewtopic.php?t=83

- https://www.quora.com/How-is-G2A-not-banned-yet-They-are-losing-companies-a-lot-of-money

- https://support.petalcard.com/hc/en-us/articles/360005310633-I-ve-had-a-pending-transaction-for-over-5-days-What-should-I-do

- https://community.oneplus.com/thread/62481

- https://gocardless.com/guides/posts/how-long-does-a-bank-transfer-take/

- https://www.volopay.com/au/blog/reasons-for-delay-in-bank-transfers/

- https://help.flywire.com/hc/en-us/articles/360013042873-Why-is-my-debit-credit-card-payment-not-going-through

- http://www.senso-is.hr/en/processing-of-payment-orders.aspx

- https://www.nab.com.au/personal/online-banking/fast-payments

- https://www.experian.com/blogs/ask-experian/what-is-pending-transaction/

- https://help.hcltechsw.com/commerce/7.0.0/com.ibm.commerce.payments.events.doc/concepts/cppedpglass.html

- https://pay.com/blog/payment-processing-work

- https://gocardless.com/guides/posts/what-does-it-mean-when-a-payment-is-pending/

- https://www.quora.com/Do-pending-transactions-mean-that-the-money-has-already-been-taken-out

- https://gocardless.com/en-us/guides/posts/guide-to-payment-processing-times-in-us/

- https://www.helpwithmybank.gov/help-topics/bank-accounts/electronic-transactions/wire-transfers/wire-transfer-unsuccessful.html

- https://www.nationwide.co.uk/help/payments/pending-transactions

- https://support.ignitionapp.com/en/articles/5022780-why-do-ach-payments-take-a-long-time-to-clear

- https://www.airwallex.com/blog/why-your-bank-transfer-is-delayed

- https://www.depositaccounts.com/blog/transferring-money-between-banks-takes-forever.html

- http://help.aisleplanner.com/en/articles/2009820-how-long-does-it-take-for-an-online-payment-to-hit-my-bank-account

- https://supporthub.g2a.com/seller/en/solving-problems/payment-reversals

- https://www.barclays.co.uk/help/payments/payment-information/bacs-chaps-faster-payments/

- https://www.fnbo.com/insights/personal-finance/2023/pending-transaction

- https://supporthub.g2a.com/seller/en/income-fees/how-can-i-withdraw-funds-from-g2acom

- https://www.bankrate.com/finance/credit-cards/how-to-cancel-a-pending-credit-card-transaction/